Changing course

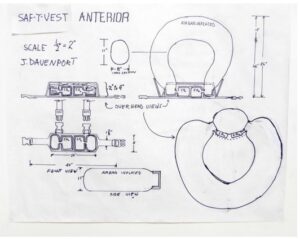

One year ago, I launched a new strategy to fund the development of an advanced prototype of the SAF-T VEST, our patented solution to reduce devastating injuries from falls among older adults. When it’s ready, we’ll evaluate it on a mannequin. Then, with safety precautions in place, we’ll put it on volunteers and test it in a special lab.

The decision came after months of encouraging and thoughtful discussions with angels and early-stage venture capital firms…and after sending in more than a dozen grant applications (This continues.). It came after we landed TV news coverage in Minneapolis and Duluth. We secured a $28,000 Launch Minnesota Innovation Grant. These are big shots on goal. We heard from administrators and nurses at senior living facilities, from hospitals and even a VA hospital. More shots on goal. But we still didn’t have an advanced prototype. Without a working, advanced prototype. It was too soon to be serious about investing. The angels said call us when you have it. Let us know when people are using it, the VCs said.

Two mentors advised me to consider crowdfunding. Rather than rely on a small number of accredited investors for substantial amounts of money (think $20K and above), why not ask all the people in your network and in your friends’ and colleagues’ networks for smaller investments (think as low as $100)? I researched four popular crowdfunding platforms. I read reviews. I asked around for advice. I needed to do something. I wanted to stay aggressive. Last May, I launched a crowdfunding campaign.

Raise or bust

It wouldn’t be easy. Unless we raised $50,000 from my network, the campaign fails. The start-up gets nothing, and investors get their money back. It required a sustained, methodical outreach to family, friends, work associates, classmates and social media contacts. Pull every P.R. and media relations tool in the toolbox. Even a few marketing friends shared their strategies. I wrote and sent thousands of emails. Posts appeared on Facebook, LinkedIn, Twitter and Instagram—sometimes 2-3 per week. If people commented, I responded. Ads ran on social media for weeks on end, with varying messages targeting audiences from young adults to seniors.

We needed a SAF-T VEST crowdfunding website. Using a template provided by the platform, we plugged in slides from our pitch deck, added fun facts with emojis and wrote our founder’s story. I used editing software to create videos, recorded narration, added closed captioning and dropped in graphics to tell our story. Made connections. Expanded the network. Don’t give up. Keep reaching out. Keep asking. Find new ways to say what you’re doing and why. I have a neighbor who leads communications and marketing for a major retailer. She knows how to leverage social media to get more people talking about your story. So, I asked her for help. Sure, she said. I’ll walk over. Guess what? She’s still helping.

If you build it…

SAF-T VEST, a wearable device to reduce

the risk of injury in falls.

By Jay A. Davenport, M.D.

Today, we’re finally ready to start crowdfunding. But wait! Haven’t I already been crowdfunding this whole time? Well, yes. And no. Crowdfunding starts with a pre-investment phase, called Testing the Waters (TTW). This is where the start-up proves to the crowdfunding platform that it can raise $50,000. But these aren’t actual investments. These are reservations or promises to invest. Some start-ups nail $50K in commitments in a short time. For others it could take a year. I spoke with one founder who kicked off his Testing the Waters phase by receiving one commitment from one investor for $200K. And…done. No more Testing the Waters. Proceed straight to Form C.

Our journey took longer, about 10 months. Investments came from people I’d never met, close friends, former co-workers and extended family. Many shared a personal story of a loved one who suffered an injury from a fall. Others shared their fears about an aging parent or spouse. Each investor got a handwritten thank you card. In March, a few more investment reservations put us over the top. Looking back, it feels like we met two goals. We hit our minimum raise, of course. But we also created more awareness for our work. People told other people. I learned what it takes to expand my network and make new connections.

Illustration by Dan O’Leary

Sweating the details

Now, we’re close to filing Form C with the U.S. Securities and Exchange Commission. The filing is a formal disclosure about our startup. We share details about our business structure, our financials, our advisors, when we’ll go to market and when we expect to make a profit. We shared a list of challenges that might keep us from succeeding. Very soon, all those who promised to invest will be contacted to confirm their decision. Then it’s real. Those investments go through. We’ll try to raise our profile even higher, so new investors can find us, learn what we’re doing, and help speed our progress.

But we need to hurry. A new study found the death rate from falls among older adults doubled over the last 20 years. Recently an engineer spoke to a group of us, all founders trying to get their big idea off the ground. She talked about prototypes and why they’re so important. She said making it perfect is not as important as making it work. Get it done. Then she quoted Leonard Bernstein, a legendary composer and conductor.

“To achieve great things, two things are needed: a plan and not quite enough time.”

Check. And check.

# # #